Indian Economy – Yearwise Questions – RBI – Banking And Market – W.B.C.S. Mains Examination.

THE ANSWERS ARE MARKED IN BOLD.Continue Reading Indian Economy – Yearwise Questions – RBI – Banking And Market – W.B.C.S. Mains Examination.

WBCS Main Question Paper – 2019

- In which year was the Reserve Bank of India established?

(A) 1935

(B) 1940

(C) 1947

(D) 1949 - Which one of the following rates is not determined by the Reserve Bank

of India?

(A) CRR

(B) SLR

(C) Repo Rate

(D) Prime Lending Rate - NABARD is associated with

(A) industrial development

(B) urban development

(C) rural development

(D) development of railways - Bank Rate is an Instrument of

(A) credit control

(B) reducing fiscal deficit

(C) reducing deficit financing

(D) increasing tax revenue - Consider the following statements regarding Prompt Corrective Action

Plan of RBI:

(i) PCA norms permit RBI to put in place certain restrictions such as halting branch expansion and stopping dividend payment etc.

(ii) The norms are also capable of even capping a bank’s lending limit to one entity or sector.

(iii) Under PCA, the RBI is also capable of superseding the bank’s board.

Select the correct answer:

(A) (i) and (ii) only

(B) (i) and (iii) only

(C) (ii) and (iii) only

(D) (i), (ii) and (iii) - Which one of the following is an example of derivative?

(A) Warrants

(B) Swaptions

(C) Baskets

(D) All of the above - Which of the following are considered to be Stressed Assets of Banks?

(A) NPAs

(B) Restructured Loans

(C) Written off Assets

(D) All of the above - _____ is the venture capital assistance at the stage where the project

started to fetch profit but not reached in its full efficiency.

(A) Startup Capital

(B) Bridge Capital

(C) Mezzanine Capital

(D) Seed Capital - Fully automated screen based trading system NSE is known as

(A) BOLT (BSE)

(B) NEAT

(C) ALBM

(D) BLISS - Securitisation and Reconstruction of Financial Assets and Enforcement

of Security Interest (S A R F A E S I) Act passed in the year

(A) 1992

(B) 2005

(C) 2002

(D) 2000 - ______ is the regulator of mutual funds in India.

(A) RBI

(B) SEBI

(C) Both SEBI and GOI

(D) IRDA - Which of the following is not a quantitative credit control tool of RBI?

(A) Bank Rate

(B) Margin requirements

(C) SLR

(D) Open market operation - The chief promoter of National Securities Depository Limited (NSDL) is

(A) NABARD

(B) NSCCL

(C) NSE

(D) BSE - The public sector banks in India have the largest number of branches in

which of the following countries?

(A) Singapore

(B) UAE

(C) UK

(D) Hong Kong - The corpus of funds and its duration is fixed in case of _____ fund.

(A) Open ended

(B) Close ended

(C) Balanced

(D) Income - The RBI has said that PPI users will have no liability if they report fraud

within three days. Hence the term PPI stands for

(A) Postpaid Payment Instruments

(B) Permitted Payment Instruments

(C) Primary Payment Instruments

(D) Prepaid Payment Instruments - A loan offered by a group of lenders who work together to provide funds

for a single borrower is called

(A) Bridge Loan

(B) Assignment

(C) Overdraft

(D) Syndicate Loan - Andhra Bank has announced to deploy over 1600 BCs to boost financial

and non-financial transactions. Here the term BC stands for

(A) Branch Correspondents

(B) Bank Centres

(C) Business Correspondents

(D) Business Centres - Financial Inclusion as per RBI means:

(A) Greater Consumer Protection for newly included customers.

(B) An easily accessed and speedy grievance redressal process.

(C) Expanded efforts on financial literacy.

(D) All of the above - Indian Foreign Exchange Reserves comprises of

(A) Gold & SDR

(B) Reserve Tranche Position (RTP) in the IMF

(C) Foreign Currency Asset (FCA)

(D) All of the above - RBI uses reverse repo to absorb liquidity.

The statement is

(A) True

(B) False

(C) Partly True

(D) Does not apply - Devaluation of currency leads to:

(A) Fall in domestic price

(B) Increase in domestic price

(C) Can’t be predicted

(D) None of the above - What is FEMA?

(A) First Exchange Management Act

(B) Foreign Exchange Management Act

(C) Foreign Exchequer Management Act

(D) Foreign Evaluation Management Act - 1st Governor of RBI IS

(A) Osborne Smith

(B) CD Deshmukh

(C) Raghu Ram Rajan

(D) Urjit Patel - Variation in margin requirements —

(A) Quantitative credit control

(B) Qualitative credit control

(C) Both (A) and (B)

(D) None of the above - EXIM Bank was set up

(A) January 1, 1982

(B) April 15,1980

(C) September, 1993

(D) October, 1975 - Incase RBI wants to make it more expensive for the banks to borrow

money it ______

(A) increases the repo rate

(B) reduces the repo rate

(C) increases in the reverse repo rate

(D) decreases reverse repo rate - There are three main treasury bills in India

(A) 91 day, 182 day and 364 day

(B) 92 day, 183 day and 365 day

(C) 93 day, 184 day and 366 day

(D) None of the above - An instant real-time inter-bank electronic funds transfer system, which

offers an inter-bank electronic fund transfer service through mobile phones

known as

(System is UPI, Technology is IMPS)

(A) RTGS

(B) NEFT

(C) IMPS

(D) UPI - An investment plan in which the Company pays return to investors from

the new capital coming in from new investors instead of the profits of the

business known as

(A) Underwriting

(B) Ponzi scheme

(C) Mutual fund

(D) Para Banking - Magnetic Ink Character Recognition (MICR) code is a

(A) 7 digit code

(B) 8 digit code

(C) 9 digit code

(D) 10 digit code - Securities and Exchange Board of India (SEBI) was given statutory

status and powers through an ordinance promulgated on

(A) January 30, 1992

(B) April 12, 1988

(C) April 10, 1992

(D) April 19, 2000 - The illegal practice of trading on the stock exchange to one’s own

advantage through having access to confidential information is known as

(A) Bull market

(B) Bear market

(C) Insider trading

(D) Initial Public Offering (IPO) - Withdrawal of currency from circulation to ambush black market

specially Rs.500 and Rs.1000 banknotes were demonetized, although

Rs.500 note was remonetized on—

(A) January, 1946

(B) January, 1978

(C) November, 2016

(D) None of the above - Money policy increases the inflation rate is known as

(A) Cheap money policy

(B) Dear money policy

(C) Hot money

(D) Flat money - The instruments issued by registered FIIS to overseas investors, who

wish to invest in Indian stock markets without registering themselves with

SEBI – known as

(A) Certificates of Deposit (CDs)

(B) Participatory notes (P-notes)

(C) Currency Derivatives

(D) Foreign exchange reserves

WBCS Main Question Paper – 2018

- Collateralized Borrowing the Lending Obligation (CBLO) is a .

a) Money Market Instrument

b) Monetary Policy Instrument

c) Investment fund

d) Capital Market Instrument - The concept of ‘Universal Banking’ was implemented in India on the

recommendations of

a) Abid Hussain Committee

b) RH Khan Committee

c) S. Padmanabhan Committee

d) Y. H. Malegam Committee - Narshimham Committee recommendations are regarding which sector?

a) Banking

b) Industries

c) Rural

d) Service - The apex organisation of Industrial finance in India is

a) IDBI

b) RBI

c) ICICI

d) IFCI - What is FEMA?

a) First Exchange Management Act

b) Foreign Exchequer Management Act

c) Foreign Exchange Management Act

d) Foreign Evaluation Management Act - How many banks were nationalized in 1969?

a) 12

b) 13

c) 14

d) 15 - SIDBI stands for

a) Small Industrial Development Banker Institute

b) Small Industries Design Bank of India

c) Small Industries Development Bank of India

d) Small Innovation Development Banker’s Institute - The one rupee note bears the signature of

a) RBI Governor

b) President of India

c) Finance Minister

d) Finance Secretary - The basic regulatory authority for mutual funds and stock exchange lies with

a) Government of India

b) Reserve Bank of India

c) Securities and Exchange Board of India

d) Stock Exchange - The main function of EXIM bank is

a) to help RBI in regulation of foreign exchange.

b) to prevent unlicensed transaction

c) to promote exports and curtail imports

d) to conserve foreign exchange - The liabilities of commercial bank are

(i) time deposits

(ii) security holdings

(iii) demand deposits

(iv) advances from central bank

a) (i), (ii), (iii)

b) (i), (iii), (iv)

c) (ii) and (iii)

d) (iii) and (i) - Which of the following statements regarding Regional Rural Bank (RRB)

in India is correct?

i) The basis aim of setting up RRB is to develop rural economy

ii) The area of RRBs is limited to a specific region comprising one or more districts.

iii) RRBs are sponsored by Commercial Banks.

Select the answer.

a) (i) only

b) (i) and (ii) only

c) (ii) and (iii) only

d) (i), (ii), (iii) - Bank rate is the rate at which

a) a bank lends to public

b) RBI lends to public

c) Government of India lends to other countries

d) RBI lends to commercial banks - Interests payable on savings bank accounts in India is .

a) not regulated

b) regulated by RBI

c) regulated by Central Government

d) regulated by State Governments - Which regulatory authority has revamped panel on alternative

investment?

a) RBI

b) IRDA

c) SEBI

d) PDRA - Who works as RBI’s agent at places where it has no office of its own?

a) State Bank of India

b) Ministry of Finance

c) Government of India

d) International Monetary Fund - A Public Debt Officer works as investment banker to the .

a) Public

b) Commercial Banks

c) RBI

d) Government - All who mints the coins in India?

a) Ministry of Finance

b) Reserve Bank of India

c) Prime Minister’s Office

d) Commerce and Industry Ministry - The oldest stock market of India is

a) Bombay Stock Exchange

b) Ahmedabad Stock Exchange

c) Bangalore Stock Exchange

d) Hyderabad Stock Exchange - RBI revision of Repo/Reserve Repo rate by 10 basis points implies,

which among the following fractions?

a) 1%

b 10%

c) 100%

d) 0.10% - Which of the following is true about the restrictions of RBI?

i) It is not to compete with the commercial banks.

ii) It is not allowed to pay interest on its deposits.

iii) It cannot engage directly or indirectly in trade.

iv) It cannot acquire or advice loans against immovable property. - v) It is prohibited from purchasing its own shares or the shares of any other

bank or any company or granting loans on such security.

a) Only (i), (ii), (iii) and (iv)

b) Only (v)

c) All of the above

d) None of the above - Which of the following is called a banker’s Cheque?

a) Demand draft

b) Debit card

c) Pay order

d) Fixed deposit - Which of the following is not the work of RBI?

a) Bank of the banks

b) Credit controller

c) Custodian of foreign currency - d) Allocating funds directly to the farmers for agricultural

development - Which of the following words is not used in Monetary Policy?

a) Cash Reserve Ratio

b) Repo Rate

c) Bank Rate

d) Blue Chip - Which of the following is not a function of RBI?

a) To assume responsibility of meeting directly or indirectly all

reasonable demands for accommodation

b) To hold cash reserves of commercial banks

c) To assume responsibility of all banking operations of the government

d) To assume responsibility of statistical analysis of data related to macroeconomy of India - If cash reserve ratio is lowered by RBI, its impact of credit creation will

be to

a) increase it

b) decrease it

c) no impact

d) cannot be determined - Which of the following is wrongly matched?

a) Share market—stock exchange

b) Interest rate—fiscal policy

c) Export subsidy—fiscal policy

d) General price index—inflation - How many Regional Rural Banks are working in India as of January,

2018?

a) 59

b) 60

c) 61

d) 56 - The RBI issues

a) all currency notes

b) all currency notes except one rupee notes

c) all currency notes except 100 rupee notes

d) only notes of Rs.10 and above - Bring out the only incorrect statement:

a) Reverse Repo operation by RBI aims at injecting/increasing

liquidity

b) SDR refers to special drawing rights

c) Rupee appreciation results in decrease in imports.

d) Increase in inflation rate leads to decline in real interest rate - Investment in which among the following is the Most Risk Free Asset of

a Bank as per the RBI guidelines?

a) Housing Loans

b) Government Approved Securities

c) Venture Capital Investment

d) Loans against Jewellery - If the Reserve Bank of India wants to block/hinder the capital outflows

and contain the currency depreciation, which among the following will be the

most possible action?

a) Increase Interest Rates

b) Decrease Interest Rates

c) Purchase Government Bonds

d) Decrease Statutory Liquidity Ratio - RBI has allowed which banks to become Small Finance Banks under

certain criteria?

a) Rural Cooperative Banks

b) District Cooperative Banks

c) Urban Cooperative Banks

d) None of the above - In India, the Foreign Exchange Reserves are kept in the custody of

which among the following?

a) Ministry of Finance

b) EXIM bank

c) Reserve Bank of India

d) Selected Public Sector Banks - If the Reserve Bank of India wants to increase the cash reserves of

commercial banks, which among the following would be the most probable

step taken by it?

a) Release Gold from its reserves

b) Buy bonds in the open market

c) Prohibit the transactions that involve bill of exchange

d) Increase the tranche reserves with the IMF - The minimum interest rate of a bank below which it is not viable to lend,

is known as

a) Reserve Rate

b) Base Rate

c) Marginal Rate

d) Prime Lending Rate - Which of the following is used to denote broad money?

a) M1

b) M2

c) M3

d) M4 - NABARD was established in the

a) Fourth Five Year Plan

b) Fifth Five Year Plan

c) Sixth Five Year Plan

d) Eighth Five Year Plan

WBCS Main Question Paper – 2017

- Which one of the following groups of items is included in India’s

foreign-exchange reserves ?

(A) Foreign-currency assets, Special Drawing Rights and loans from

foreign countries

(B) Foreign-currency assets, gold holdings of the RBI and SDRs

(C) Foreign-currency assets, loans from the World Bank and SDRs

(D) Foreign-currency assets, govt. holdings of the RBI and loans from the

World Bank - When did the Foreign Exchange Regulation Act (FERA) come into

being ?

(enacted – Sept 1973, came in force – 1st Jan 1974)

(A) 1973

(B) 1975

(C) 1980

(D) 1981 - When did India become a member of the IMF ?

(A) 1947

(B) 1945 (27th Dec)

(C) 1960

(D) 1951 - Land Development banks in India are owned by the

(A) RBI

(B) State Governments

(C) Commercial Banks

(D) Co-operative Societies - Through open market operation, the RBI purchase and sell

(A) foreign exchange

(B) gold

(C) government securities

(D) All of the above - When the Reserve Bank of India increases the Cash Reserve Ratio

(CRR) ?

(A) When the Indian economy have high rate of inflation

(B) When the Indian economy have low rate of inflation

(C) The demand of goods and services is very low

(D) None of the above - What kind of convertibility of currency is permitted in India ?

(A) Capital account

(B) Current account

(C) Both (A) and (B)

(D) Partial in both (A) and (B) - The Narsimham Committee on the Financial System of India made its

recommendations in two phases

(A) 1991 and 1999

(B) 1991 and 1998

(C) 1990 and 1999

(D) 1990 and 1998 - The rate at which RBI lends to the banking system is

(A) Bank Rate

(B) Statutory Liquidity Rate

(C) Cash Reserve Ratio

(D) None of the above - A landmark in the evolution of agricultural finance is the establishment

of the National Bank for Agriculture and Rural Development which was set

up in the year

(A) 1980

(B) 1986

(C) 1982

(D) 1985 - Sources of agricultural credit for India are

(A) Co-operative credit

(B) Commercial bank credit

(C) Government loans

(D) All of the above - Which bank provides Financial assistance for Export and Import ?

(A) RBI

(B) NABARD

(C) EXlM Bank

(D) SIDBI - In India which of the following measures of money denotes the Broad

Money ?

(A) M1

(B) M2

(C) M3

(D) M4 - Who has the authority to mint the coins in India ?

(A) Reserve Bank of India

(B) Ministry of Finance

(C) Ministry of Corporate Affairs

(D) Ministry of Affairs - Which of the following is the biggest contributor of foreign exchange

reserve of India ?

(A) Foreign currency assets

(B) Gold

(C) Reserve tranche with IMF

(D) Special drawing rights (SDR) - How much-interest is paid by the RBI on the money deposited under

the CRR measure ?

(A) Equal to the rate of CRR

(B) More than the CRR

(C) Less than the CRR

(D) No interest is paid by the RBI - The Co-operative Credit Societies have a

(A) two-tier structure

(B) three-tier structure

(C) four-tier structure

(D) five-tier structure - The Board of Industrial and Financial Reconstruction (BIFR) came into

existence in

(A) 1984

(B) 1986

(C) 1987

(D) 1989 - Since 1983, RBl’s responsibility with respect to regional rural banks

was transferred to

(A) ARDC

(B) SBI

(C) NABARD

(D) PACs

WBCS Main Question Paper – 2016

- What rate of interest is effective at the time of giving short-term loan to

the Commercial Banks by the Reserve Bank of India ?

(A) Repo Rate

(B) Bank Rate

(C) Reverse Repo Rate

(D) None of the above - Credit Planning in the banking sector of the country has been introduced

by-

(A) Reserve Bank of India

(B) State Bank of India

(C) Commercial Banks

(D) All of the above - What are the institutional sources of agricultural credit in our country ?

(A) Commercial Banks

(B) Regional Rural Banks

(C) NABARD

(D) All the above stated sources - Open market operation refers to-

(A) borrowing by scheduled banks from the RBI.

(B) borrowing by scheduled banks to industry and trade.

(C) Purchase and sale of government securities.

(D) deposit mobilisation.

- Which of the following is a function of NABARD ?

(A) Monitoring flow of ground level credit in agriculture

(B) Credit planning and monitoring

(C) Formulation of operational guidelines for rural financial institutions

(D) All of the above - The percentage of demand and time liabilities that banks have to keep

with RBI is-

(A) SLR (Statutory Liquidity Ratio)

(B) CRR (Cash Reserve Ratio)

(C) OMO (Open Market Operations)

(D) Bank Rate - The monetary policy of the Reserve Bank of India tackled the economic

depression in recent years by

(A) lowering the Repo rate and Reverse repo rate.

(B) lowering the rate of marginal Standing Facilities.

(C) lowering the Statutory Liquidity Ratio and the Cash Reserve Ratio.

(D) All of the above. - At what time India announced full convertibility of Rupee in the current

account into foreign currency ?

(A) 1991

(B) 1992

(C) 1993

(D) 1994 - The market for transaction of Government Securities is called –

(A) Gilt-edged market

(B) Industrial Securities market

(C) Call money market

(D) None of the above - Sensitive Index or Sensex represents the prices of shares of the

main ______ shares in the stock exchange.

(1st Jan 1986)

(A) 40 shares

(B) 30 shares

(C) 50 shares

(D) 60 shares - Which of the following is not advantage of full capital account

convertibility ?

(A) Encourages import

(B) Boosts exports

(C) Easy access to forex

(D) Promotes trade and capital flows between nations - The RBI can increase the money supply in the market by-

(A) selling government securities.

(B) buying government securities.

(C) borrowing money from Commercial Banks.

(D) None of the above. - Operating parameters of commercial banks as percentage assets are

the highest case of-

(A) Foreign banks

(B) Private banks

(C) All scheduled commercial banks

(D) None of the above - Mention the weakness of the nationalised commercial banks.

(A) Increase in Non-performing assets

(B) Decline of Capital Adequacy Ratio

(C) Low Capital Asset Ratio

(D) All of the above - Regional Rural Banks work at –

(A) Hobli level

(B) Taluk level

(C) District level

(D) All levels - When was the EXIM Bank of Export-Import Bank set up in India ?

(A) 1980

(B) 1982 (1st Jan)

(C) 1985

(D) 1987 - The banks are required to maintain certain ratio between their cash in

hand and total assets. This is called —

(A) Statutory Liquid Ratio

(B) Cash Reserve Ratio

(C) Liquid Ratio

(D) Statutory Ratio - The dual roles of the Reserve Bank is the Regulatory and Promotional

roles have made the monetary policy a ‘policy of controlled expansion’ —

How ?

(A) By maintaining a safe limit to credit expansion required for development

of the country.

(B) By lowering the Cash Reserve Ratio and Repo Rate within limits.

(C) By helping the growth process through raising the availability of finance

for development of agriculture, industry, export trade and service sector

(D) All the above

- The process by which RBI or any Central Bank protects the economy

against adverse economic shocks is known as –

(A) protection

(B) liberalisation

(C) stabilisation

(D) sterilization - Which of the following is not included under the money market ?

(A) RBI

(B) Commercial Banks

(C) SEBI

(D) None of the above - Which among the following will be a debit entry in India’s balance of

payments ?

(A) Imports of goods by India

(B) Income of Indian investments abroad

(C) Receipts of transfer payments

(D) Exports of services by India - Which of the following banks was not Nationalised in 1969 ?

(A) Vijaya Bank

(B) Canara Bank

(C) Bank of India

(D) Central Bank of India - What is the Cash Reserve Ratio (CRR) ?

(A) The fraction of the deposits that Commercial Banks lend to the customer

(B) The fraction of the deposits that RBI must keep with Commercial Banks

(C) The fraction of the deposits that Commercial Bank must keep with

RBI

(D) None of the above - Who issues metallic coins in India ?

(A) RBI

(B) Government of India

(C) Banks and Financial Institutions

(D) Any of the above can issue it - Lead Bank Scheme as a part of Credit Planning has been introduced by

–

(A) Commercial Banks in district wise arrangement

(B) Regional Rural Banks

(C) State Co-operative Banks

(D) Reserve Bank of India - What is FEMA ?

(A) First Exchange Management Act

(B) Foreign Exchequer Management Act

(C) Foreign Exchange Management Act

(D) Foreign Evaluation Management Act - The Reserve Bank of India was nationalised on-

(A) January 1, 1949

(B) April 1, 1948

(C) January 1, 1948

(D) April 1, 1949 - In pursuance with the recommendations of Narsimhan Committee, the

RBI has framed new guidelines-

(A) to govern entry of new private sector banks to make the banking

sector more competitive

(B) to reduce the freedom given to the banks to rationalise their existing

branch network

(C) to set up more foreign exchange banks

(D) to lend more easily for industrial development - The Co-operative credit societies have a —

(A) two-tier structure

(B) three-tier structure

(C) four-tier structure

(D) five-tier structure

WBCS Main Question Paper – 2015

- “High Street Banking” lays emphasis on

(A) Retail lending

(B) Corporate lending

(C) Long-term risk free lending

(D) Short-term lending - Which of the following is not correct about White Label ATMs

(A) These are owned and operated by a third party non-banking firm

(B) They serve customers of all banks

(C) These entities have a mandate to deploy 80% of ATMs in rural

locations

(D) The main objective is financial inclusion - Which of the following is not correct ?

(A) Credit rating is done to assess the credit worthiness of the prospective

borrower

(B) It is done in case of individuals and even countries

(C) Equity share is rated in the rating

(D) Ratings are an investor service - RBI is required to maintain a minimum reserve equivalent of Rs.

_____ core in gold and foreign currency with itself

(A) 1000 crore

(B) 200 crore

(C) 500 crore

(D) 2000 crore - Which of the following is not correct ?

(A) Repo rate is an abbreviated form of “the rate of repurchase”

(B) Repo rate is also known as “rate of discount”

(C) The Repo rate was introduced in December, 1992

(D) Only A & C are not correct

- The Reverse Repo Rate is currently fixed at

(A) 5.25%

(B) 5.75%

(C) 4.25%

(D) None of the above - Which of the following is not true :

(A) Marginal standing facility (MSF) came into effect from May, 2011

(B) Under the scheme banks can borrow overnight upto 1% of their

net demand and time liabilities.

(C) The minimum amount which can be accessed through MSF is Rs. 1

crore

(D) Banks can borrow through MSF on all working days - Financial sector reform implied

(A) More loan to priority sector

(B) More fiscal monetary link

(C) Decrease in SLR

(D) None of the above - Indian Foreign Exchange Reserves comprise of

(A) Gold & SDR

(B) Reserve Tranche Position (RTP) in the IMF

(C) Foreign Currency Assets (FCAs)

(D) All of the above - The current rate of CRR (Cash Reserve Ratio) is _____ %

(A) 3.5

(B) 4

(C) 4.5

(D) 5 - Which of the following is not true

(A) Bank rate is the interest rate which RBI charges on its long term lending

(B) The rate was realigned with the MSF (Marginal Standing Facility)

by the RBI in February 2012

(C) The Banks, financial institutions etc. borrow through this route

excepting Government of India

(D) The rate has direct impact on long term lending activities - Which of the following is not a function of the Reserve Bank of India

—

(A) Bank of Issue

(B) Banker’s Bank and lender of the last resort

(C) Agent of Government of India in World Bank

(D) Announces the credit and monetary policy for the economy - Financial inclusion as per RBI means

(A) Greater consumer protection for newly included customers

(B) An easily accessed and speedy grievance redressal process

(C) Expanded efforts on financial literacy.

(D) All of the above

- Inflation can be controlled by this method

(A) Reducing SLR

(B) Reducing CRR

(C) Increasing bank rate

(D) None of the above - New money supply is created when

(A) Loan from RBI increases

(B) Loan from commercial banks increases

(C) Loan from public increases

(D) None of the above - Code the incorrect one.

Sources of long term finance of private industrial sector are

(A) Shares

(B) Debentures

(C) Loan from development banks

(D) Loan from RRBs - Commercial banks are –

(A) The only source of long term finance for industries

(B) One of the sources of long term finance

(C) Usually do not get involved in term lending

(D) None of the above - CRR instrument applies on –

(A) Scheduled commercial banks

(B) (A) and the investment companies

(C) CRR applies on non-banking financial institutions

(D) None of the above - CRR as an instrument of credit control is usually

(A) Highly effective

(B) Not at all effective

(C) Partly effective

(D) Uncertain - Treasury bills are instruments of getting credit for such period

(A) Long term

(B) Very long term

(C) Medium term

(D) Short term - Cash reserve ratio (CRR) and statutory liquidity ratio (SLR) were

most used in pre-reform period

The statement is :

(A) True

(B) False

(C) Partly true

(D) None of the above - Open Market Operations (OMO) is

(A) A direct way to control credit

(B) An indirect way to control credit

(C) A technique to assist foreign exchange dealers in doing their business

(D) Both (A) and (C) - By repo rate, Reserve Bank of India (RBI)

(A) Injects liquidity into system

(B) Absorb liquidity from the system

(C) Helps industries in getting fund

(D) Both (A) and (C) - Monetisation of loans through issue of Treasury Bills brings

(A) Increase in money supply

(B) Decrease in money supply

(C) Increase in foreign exchange reserve

(D) Both (A) and (C) - The process of bill discounting is

(A) Long term loan taken-by commercial banks

(B) Trade credit

(C) Government loan from capital market

(D) Both (A) and (C) - The period prior to economic reform in India observed

(A) Free rate of Interest regime

(B) Administered rate of interest regime

(C) High profitability of commercial banks

(D) Both (A) and (C) - Indian employment is generated mostly in this sector

(A) Registered Sector

(B) Government Sector

(C) Un-registered and Un-organised sector

(D) Both (A) and (B) - National Development Council was set up in

(A) 1948

(B) 1949

(C) 1952

(D) 1954 - Which of the following statements is correct ?

(A) RBI has direct control on non-banking financial intermediaries

(B) RBI does not control Export-Import Bank

(C) RBI does not have any role in controlling foreign exchange crisis

(D) RBI can control foreign exchange reserve - Bank nationalization did not have this impact

(A) Total deposits of Banks increased much

(B) Priority sector got more loan than before

(C) Branch expansion took place

(D) Security and safety of depositors declined - Long Term capital for industrial sector mainly comes from

(A) RBI

(B) NABARD

(C) Lead bank

(D) Capital Market - Role of RBI in the plan period followed this line

(A) Expansion of developmental loan

(B) Control of Inflation

(C) Control of Credit

(D) All of the above - Indian currency is

(A) Totally convertible in capital account

(B) Partly convertible in capital account

(C) Not convertible in capital account

(D) None of the above - NABARD provides help by

(A) Giving agricultural refinance facilities

(B) Discounting Bills

(C) Giving term loan to banks

(D) Giving direct loan to industries - Rural credit in India comes mainly from

(A) Regional Rural banks

(B) Commercial banks

(C) Co-operative banks

(D) Money lenders - Bank nationalisation observed, disbursement of large part of priority

sector loan to

(A) Small farmers

(B) Big farmers

(C) Small scale industries

(D) Household and cottage industries

- RBI uses reverse repos to absorb liquidity

The Statement is –

(A) True

(B) False

(C) Partly True

(D) Does not apply - Responsibility of agricultural credit and refinance lies on the following

institution

(A) RBI

(B) NABARD

(C) State Bank of India

(D) None of the above

WBCS Main Question Paper – 2014

- Repo Rate is the Rate at which

(A) RBI borrows from Commercial banks

(B) RBI lends to commercial banks

(C) RBI borrows from public

(D) None of the above - M3 money is –

(A) M2 + Net time deposits with banks

(B) M1 + M2

(C) M4 – M1

(D) M1 + savings deposits with post office - Functions of Money –

(A) Money as a medium of exchange

(B) Money as a unit of account

(C) Money as a standard of deferred payment

(D) All the above three - Cash Reserve Ratio (CRR) is –

(A) The share of deposits commercial banks must keep with RBI

(B) The share of deposits RBI must keep with Central Govt.

(C) The share of deposits banks give as loan to the industry

(D) None of the above - From Non-performing Asset (NPA) Banks

(A) Cannot earn any interest

(B) Can earn maximum profits

(C) Make assets of its own

(D) All of the above - RBI was nationalised on –

(A) 21st January, 1950

(B) 1st January, 1949

(C) 3rd July, 1966

(D) None of the above - Head-quarter of SIDBI (Small Industries Development Bank) is located

in –

(A) New Delhi

(B) Mumbai

(C) Lucknow

(D) Kolkata

8.SBI Life Insurance Company is associated with –

(SBI, BNP Paribas – Joint Venture)

(A) SBI and LIC of India

(B) SBI and Bank of Bangladesh

(C) SBI and Cardiff’S. A. of France

(D) None of the above

- Export-Import Bank of India (EXIM) was established in –

(A) 1991

(B) 1999

(C) 1982 (1st Jan)

(D) 2004 - Note of Rs.1000 was introduced by RBI in the year

(Nov 2000 – Nov 2016)

(A) 1991, July

(B) 2000, October

(C) 1999, December

(D) 2005, November

11.Infrastructure Development Finance Company (IDFC) was established

in India in the year –

(A) 1997 (Chennai)

(B) 1999

(C) 1998

(D) 2001

- Narasimham Committee (Second) is associated with

(A) Sugar Industry Reforms

(B) Fertiliser Industry Reforms

(C) Banking Sector Reforms

(D) None of the above - ‘Credit Card’ is an example of –

(A) Para-Banking Activities

(B) Non-Banking Activities

(C) Operation Research Activities

(D) None of the above - The number of approved share markets in India

(A) 19

(B) 20

(C) 23

(D) 24 - The First Development Financial Institution in India –

(Industrial Finance Corporation of India – 1951)

(A) IFCI

(B) IDBI

(C) SIDBI

(D) ICICI - NABARD was established in-

(12 July 1982)

(A) 4th Five Year Plan period (FYP)

(B) 5th FYP

(C) 6th FYP

(D) 8th FYP - Punjab National Bank was nationalised in

(A) 1969 (July)

(B) 1974

(C) 1981

(D) 1990 - Which of the following is not a financial regulator

(Association of Mutual Funds in India – 1995)

(A) IRDA

(B) AMFI

(C) PFRDA

(D) SEBI - Index “Residex” is associated with —

(A) Share prices

(B) Mutual Fund Prices

(C) Inflation index

(D) Land prices - Dalal Street is situated at

(A) Amritsar

(B) New Delhi

(C) Mumbai

(D) Chandigarh - The Indian rupee is fully convertible in respect of

(i) Current account of balance of payments

(ii) Capital account of balance of payments

(iii) Gold(iv) None of the above Options

(A) (i) only

(B) Both (i) and (iii)

(C) (iii) only

(D) (i), (ii) and (iii)

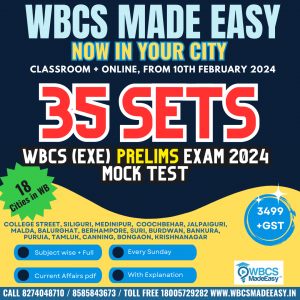

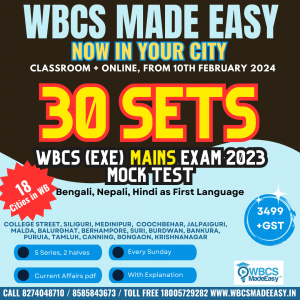

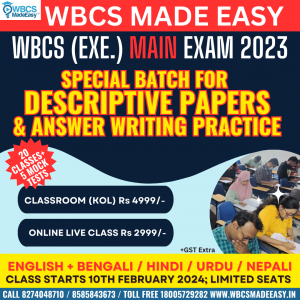

To know more about W.B.C.S. Preliminary Examination Mock Test – Click Here.

To know more about W.B.C.S. Main Examination Mock Test – Click Here.

Please subscribe here to get all future updates on this post/page/category/website

+919674493673

+919674493673  mailus@wbcsmadeeasy.in

mailus@wbcsmadeeasy.in